Today, a credit card is a common thing. What was the reason for their invention and to whom does this idea belong?

Plastic Card Predecessors

Plastic cards have several predecessors. For example, at the beginning of the 20th century, large department stores issued metal tokens to their customers. Special ledgers were kept in which a token was imprinted opposite the name of the buyer. So it was possible to track purchases.

The buyer, in turn, had to return the funds within the agreed period. Such services were used only by local, fairly well-off residents. If a person received a token (later - a card), this testified to his high position in society.

Why did you get such an idea? After all, it would be more reliable for the seller to receive payment in cash here and now. The secret is to get more benefits. If the client does not have money, he will leave the store with nothing. Accordingly, he will then spend the money elsewhere, and the loss of the buyer is a blow to the seller. This is a kind of struggle for profit and regular customers.

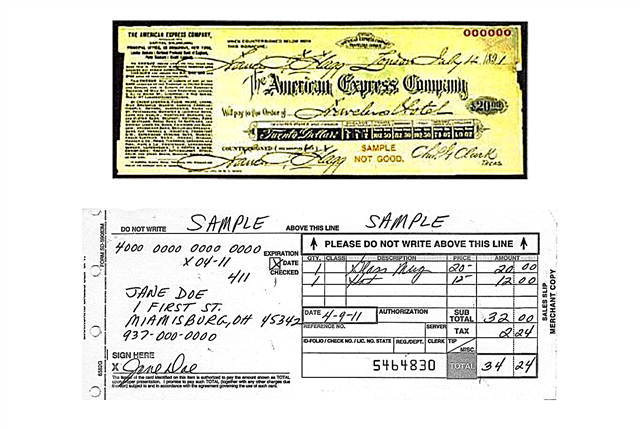

The lack of local tokens or cards is the inability to use them away from the receiving city or at another point of sale. American Express has found a way out - invented traveller's checks. The owner of the check could pay them anywhere. In case of loss or theft, it is enough to contact the office of the company.

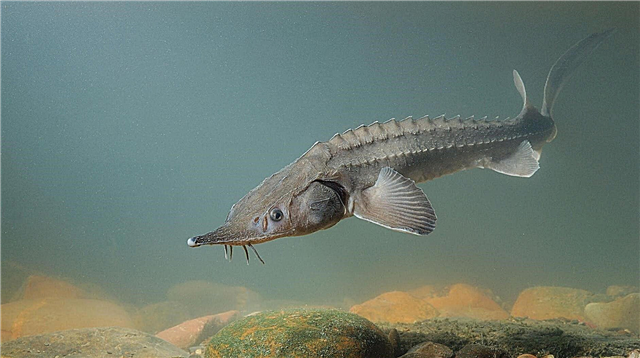

In addition to stores, customer cards began to be used at gas stations.But paper quickly fell into disrepair in this industry - this is how embossed steel plates produced by Farrington Manufacturing came about. The person accepting payment by card made an imprint of the data crowded out on it.

A real coup in terms of sale took place in the United States during the period of the 40-50s. This time is commonly called the "trade boom." A new settlement system has appeared, according to which buyers instead of cash left receipts in stores. These documents were transferred to the bank, from where the seller had already received payment for his goods.

Interesting fact: the first credit cards in the USSR appeared in 1969. In the chain of stores "Birch" began to accept cards club Diners Club. These were special stores in which payment was made in foreign currency, for certificates or in the form of checks.

Diners club

In 1950, the company appeared Diners Club. It is successfully working and is now called Diners Club International. The emergence of this company has an interesting background.

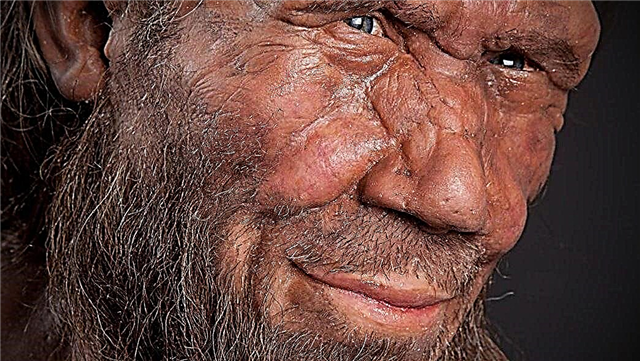

The future founder of the Diners Club, Frank McNamara, once had lunch at a restaurant and discovered that he had forgotten his wallet with money. The situation was unpleasant - there was nothing to pay for lunch. On this basis, Frank came up with the idea to organize a club, whose clients will be able to visit entertainment venues without worrying about cash.

The essence of the Diners Club is as follows. The client enters into a contract with the club, according to which Diners Club becomes his loan guarantor. After that, you can use the various services of the club's partners - all bills go to the guarantor.

Diners Club regularly sends customer statements of expenditure, and he pledges once a month to fully repay all expenses. The first cards in the amount of 200 pieces were issued in 1950, and already at the end of the year there were at least 20 thousand of them.

First bank cards

For a long time Diners Club worked without competitors. But in 1958, the Bank of America financial institution issued its credit cards with a limit of $ 500 - BankAmericard. It is worth noting that credit cards were issued by other banks before. For example, in 1951, the first Long Island Bank bank card appeared. However, it was BankAmericard that spread quickly and massively.

Interesting fact: Bank of America after the success of credit cards offered cooperation to other banks. But not a single institution sought to write the name of a competitor on its cards. So there was a single mark VISA - a payment system that still leads the market in the number of transactions.

The history of credit cards began with their simplified predecessors. At the beginning of the 20th century, these were metal tokens, which were issued only to regular customers of certain stores. Cardboard cards later appeared on which notes could be made. Then - embossed cards, and so on up to more modern plastic cards with magnetic strips and microcircuits. The first universal credit card is considered a card issued in 1950 by the company Diners Club. One of the founders of the company once could not pay for lunch in a restaurant. So he had the idea of creating credit cards.